We take a slight departure in this newsletter to bring you a few headlines that tell us where our commercial real estate industry is, and where it’s headed.

We hope you find these articles informative and encouraging.

Please stay safe this Halloween weekend.

According to global real estate advisor JLL, Asia Pacific commercial real estate investment volumes continued to rebound strongly in the first nine months of 2021, up 30% compared to the same period in 2020. [read more…]

Increased Material Costs Also a Drag on Building Completions

According to CBRE, demand for warehouse space remains historically high, but developers are struggling to complete construction projects on time due to increased material costs and shipping delays. [read more…]

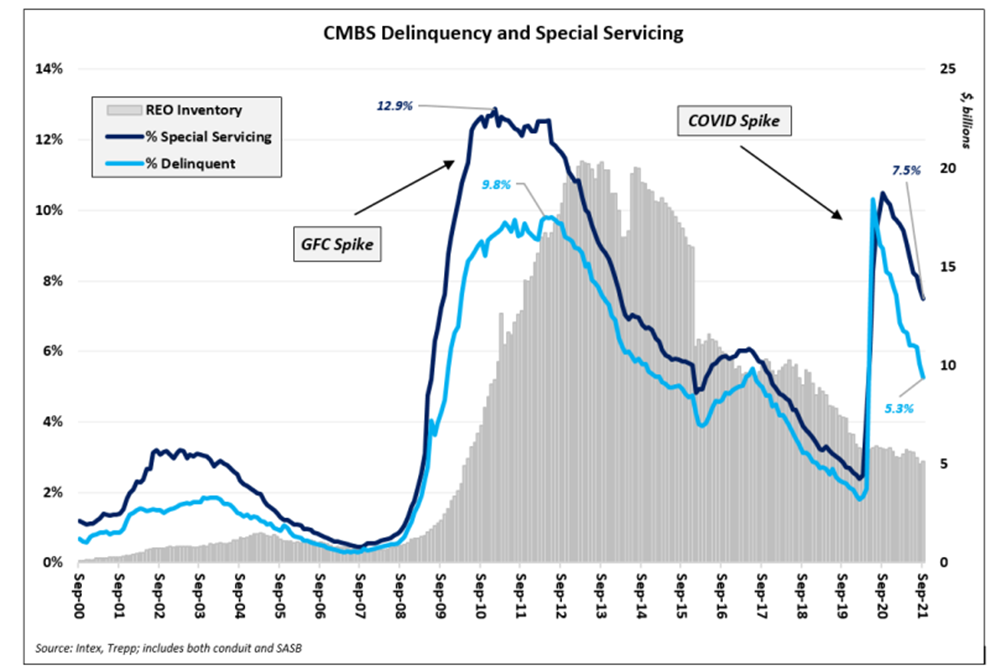

The retail commercial real estate sector has undoubtedly faced challenges throughout the coronavirus pandemic and was facing some challenges even before due to increased e-commerce. Despite the sector’s extensive efforts to make up for the downturn and the headlines showing some green shoots, several loans have fallen into the 90+ days delinquent category.

Below, we’ve compiled a list of the five largest CMBS loans backed by retail properties that are now 90 days or more behind on payment. [read more…]

Last week, the Senate Banking, Housing, and Urban Affairs held a hearing titled “How Private Equity Landlords are Changing the Housing Market.”

Democrats such as Committee Chairman Sherrod Brown (D-OH) and Senator Elizabeth Warren (D-MA) are blaming private equity firms for driving up rental costs and contributing to the affordable housing shortage. [read more…]

Staff for Sen. Thom Tillis (R-NC) confirmed to CREFC and a number of financial services trade associations last week that he will be the lead Republican cosponsor of LIBOR legislation in the Senate, alongside Sen. John Tester (D-MT). At a subsequent Senate Banking Hearing, Tillis last week said publicly that he agrees completely with a Federal legislative solution to provide a replacement framework for outstanding financial contracts tied to LIBOR. [read more…]

A few weeks ago, The TreppWire Podcast team noted green shoots in the office market, underscoring recent sales, new leases being signed, and a generally positive attitude in the news. However, as the pandemic has shown us, never does one week’s headlines make a trend, and looking at even more recent office news may paint a different picture. While headlines were not all negative, some of the biggest stories surrounding the office market were slightly more concerning. The theme? Downsizing. [read more…]

0 Comments